Your Mileage log book for tax purposes images are ready in this website. Mileage log book for tax purposes are a topic that is being searched for and liked by netizens today. You can Get the Mileage log book for tax purposes files here. Get all free photos.

If you’re looking for mileage log book for tax purposes images information linked to the mileage log book for tax purposes topic, you have pay a visit to the ideal site. Our website frequently provides you with hints for downloading the maximum quality video and image content, please kindly surf and locate more enlightening video articles and images that match your interests.

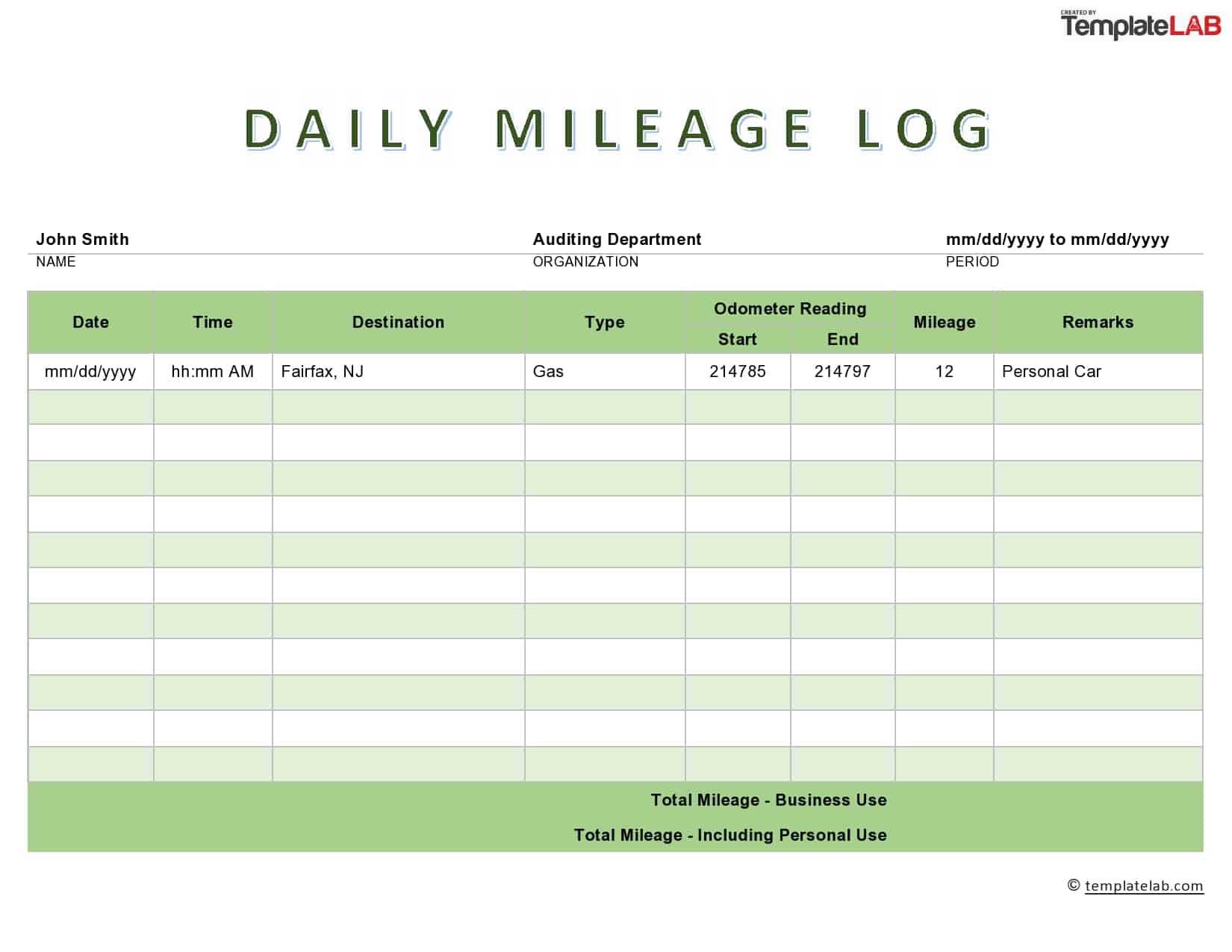

Mileage Log Book For Tax Purposes. If these documents won’t match with your mileage logs an irs fine can be 50% of your yearly income! Vehicle distance tracker and management journal for tax purposes | 605 trips… by tim demoor paperback $6.99 available to ship in 1. The hmrc permits you to use whichever reliable method you prefer to maintain your mileage log. This template will calculate the value of your business trips based on this figure.

Tax Deductions Printable Editable Vehicle Mileage From pinterest.com

Tax Deductions Printable Editable Vehicle Mileage From pinterest.com

This document can be used to file for at least a tax deduction or even a reimbursement. This means that every mile you spend driving to meet clients or to run errands for the company will be given back to you in cash, which will either be deducted from your taxes or reimbursed after your general application. Keeping mileage log for tax purposes: Fill in the amount of the expense or the total mileage driven in the amount column. A printable mileage log refers to the document you use to keep track of the miles you have driven. In order to claim such a deduction, an accurate record of mileage travelled is required.

This logbook may also be used for this purpose.

Driversnote’s log book application is always at hand to record your trips and calculate your reimbursement. The hmrc permits you to use whichever reliable method you prefer to maintain your mileage log. Here�s how you would go about filling in your mileage log: Vehicle distance tracker and management journal for tax purposes | 605 trips… by tim demoor paperback $6.99 available to ship in 1. This applies to 1099 workers: For 2020, the irs lets you deduct 57.5 cents per business mile.

Source: pinterest.com

Source: pinterest.com

Mileage log date time description location trip mileage start trip mileage end total mileage to calculate your mileage reimbursement, use our mileage calculator. Here�s how you would go about filling in your mileage log: Mileage log date time description location trip mileage start trip mileage end total mileage to calculate your mileage reimbursement, use our mileage calculator. Your business drives include trips to meet clients, pick up supplies, drives between offices and more. Fill in the amount of the expense or the total mileage driven in the amount column.

Source: pinterest.com

Source: pinterest.com

The tax agency may check your records years down the road to make sure you’re paying the right amount of tax. The hmrc says you must keep your mileage log (and other tax records) for at least five years after the 31 january submission deadline. Driversnote’s log book application is always at hand to record your trips and calculate your reimbursement. For 2020, the irs lets you deduct 57.5 cents per business mile. The tax court not only needs the mileage log for time and date, starting point, destination, business purposes, total distance but also the other costs.

Source: pinterest.com

Source: pinterest.com

Business expense reports, traffic cams, tolls, fees, etc. If you drive in your own car for business purposes, your may be eligible for a significant tax deduction to lower your taxable income. Driversnote’s log book application is always at hand to record your trips and calculate your reimbursement. At this point, both the log and its format becomes very important. 4.5 out of 5 stars.

Source: br.pinterest.com

Source: br.pinterest.com

The tax court not only needs the mileage log for time and date, starting point, destination, business purposes, total distance but also the other costs. Fill in the amount of the expense or the total mileage driven in the amount column. Fill in the daily log book with the date and time of each expense. If you drive in your own car for business purposes, your may be eligible for a significant tax deduction to lower your taxable income. This template will calculate the value of your business trips based on this figure.

Source: pinterest.com

Source: pinterest.com

Fill in the amount of the expense or the total mileage driven in the amount column. In order to claim such a deduction, an accurate record of mileage travelled is required. You can use the following log as documentation for your mileage deduction. Benefit in respect business mileage travelled in motor vehicles provided by an employer. Vehicle distance tracker and management journal for tax purposes | 605 trips… by tim demoor paperback $6.99 available to ship in 1.

Source: pinterest.com

Source: pinterest.com

Your digital car log book. If you drive in your own car for business purposes, your may be eligible for a significant tax deduction to lower your taxable income. For a mileage log sheet to be valid for irs use, it must contain some details. In order to claim such a deduction, an accurate record of mileage travelled is required. Fill in the amount of the expense or the total mileage driven in the amount column.

Source: pinterest.com

Source: pinterest.com

Fill in the amount of the expense or the total mileage driven in the amount column. This template will calculate the value of your business trips based on this figure. For 2020, the irs lets you deduct 57.5 cents per business mile. The tax court not only needs the mileage log for time and date, starting point, destination, business purposes, total distance but also the other costs. We�ve got lots of information and a number of resources here to help you log and document your business mileage, medical mileage, and charity mileage in a record keeping manner that will allow you to take advantage of irs mileage deductions for your car or truck.

Source: pinterest.com

Source: pinterest.com

Fill in the daily log book with the date and time of each expense. For 2020, the irs lets you deduct 57.5 cents per business mile. A printable mileage log refers to the document you use to keep track of the miles you have driven. Vehicle distance tracker and management journal for tax purposes | 605 trips… by tim demoor paperback $6.99 available to ship in 1. Keeping mileage log for tax purposes:

Source: pinterest.com

Source: pinterest.com

For example, let’s assume you started your business in march, but haven�t kept a mileage log for the first half of the year. Mileage tracking can be done using mileage log books. Your business drives include trips to meet clients, pick up supplies, drives between offices and more. The hmrc says you must keep your mileage log (and other tax records) for at least five years after the 31 january submission deadline. Driversnote’s log book application is always at hand to record your trips and calculate your reimbursement.

Source: id.pinterest.com

Source: id.pinterest.com

This template will calculate the value of your business trips based on this figure. Save addresses you visit frequently, add notes and set each trip’s purpose for a complete mileage log. Start with your trip logs, if you have them. There are many advantages for keeping a mileage log but the most important benefit is that with keeping this log updated, you can claim tax deductions. For a mileage log sheet to be valid for irs use, it must contain some details.

Source: pinterest.com

Source: pinterest.com

The hmrc permits you to use whichever reliable method you prefer to maintain your mileage log. In order to claim such a deduction, an accurate record of mileage travelled is required. For 2020, the irs lets you deduct 57.5 cents per business mile. 4.5 out of 5 stars. Mileage log date time description location trip mileage start trip mileage end total mileage to calculate your mileage reimbursement, use our mileage calculator.

Source: pinterest.com

Source: pinterest.com

At this point, both the log and its format becomes very important. For 2020, the irs lets you deduct 57.5 cents per business mile. In order to claim such a deduction, an accurate record of mileage travelled is required. Driversnote’s log book application is always at hand to record your trips and calculate your reimbursement. Driversnote will keep your car log book ready for download as a pdf or spreadsheet in line with hmrc requirements.

Source: pinterest.com

Source: pinterest.com

Mileage log book for taxes: Start with your trip logs, if you have them. Your digital car log book. Mileage log options for tax and reimbursement purposes. Business expense reports, traffic cams, tolls, fees, etc.

Source: pinterest.com

Source: pinterest.com

Your mileage log sheet must indicate the following. You can use the following log as documentation for your mileage deduction. Your digital car log book. A printable mileage log refers to the document you use to keep track of the miles you have driven. Benefit in respect business mileage travelled in motor vehicles provided by an employer.

Source: pinterest.com

Source: pinterest.com

Here�s how you would go about filling in your mileage log: You can use the following log as documentation for your mileage deduction. If you drive in your own car for business purposes, your may be eligible for a significant tax deduction to lower your taxable income. This template will calculate the value of your business trips based on this figure. Start with your trip logs, if you have them.

Source: pinterest.com

Source: pinterest.com

The hmrc says you must keep your mileage log (and other tax records) for at least five years after the 31 january submission deadline. For 2020, the irs lets you deduct 57.5 cents per business mile. Whether you work for some company or you are self employed, this log will help you make sure you don’t pay the taxes that you don’t owe. Fill in the daily log book with the date and time of each expense. In order to claim such a deduction, an accurate record of mileage travelled is required.

Source: pinterest.com

Source: pinterest.com

Start with your trip logs, if you have them. Keeping mileage log for tax purposes: The irs, as you would expect, will not just rely upon your word and will need some evidence of the business mileage. This means that every mile you spend driving to meet clients or to run errands for the company will be given back to you in cash, which will either be deducted from your taxes or reimbursed after your general application. Fill in the daily log book with the date and time of each expense.

Source: pinterest.com

Source: pinterest.com

Save addresses you visit frequently, add notes and set each trip’s purpose for a complete mileage log. You also need to know the total miles you drive each car during the years, which includes your business and nonbusiness driving. The tax court not only needs the mileage log for time and date, starting point, destination, business purposes, total distance but also the other costs. This logbook may also be used for this purpose. Benefit in respect business mileage travelled in motor vehicles provided by an employer.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title mileage log book for tax purposes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.