Your Margin of safety book summary images are available. Margin of safety book summary are a topic that is being searched for and liked by netizens now. You can Download the Margin of safety book summary files here. Download all royalty-free photos and vectors.

If you’re looking for margin of safety book summary pictures information connected with to the margin of safety book summary interest, you have come to the ideal blog. Our site frequently provides you with suggestions for viewing the maximum quality video and image content, please kindly hunt and find more enlightening video content and images that fit your interests.

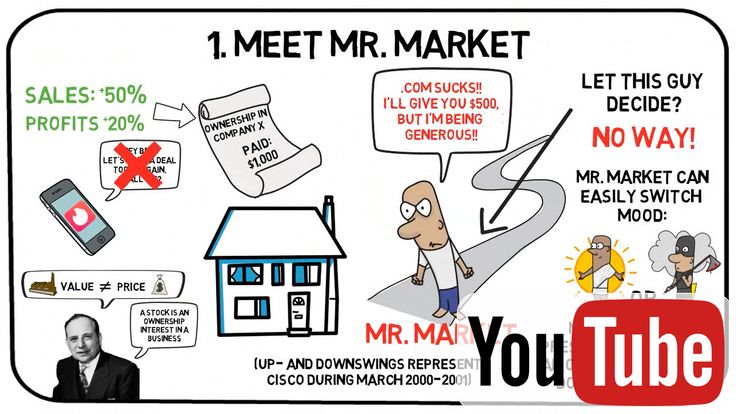

Margin Of Safety Book Summary. Let us assume that the book value per share of a company is $10, but the market price of one share is $20. A margin of safety is necessary because valuation is an imprecise art, the future is unpredictable, and investors are human and make mistakes. However it was written 40 years ago so i�m trying to eliminate the things that are not so relevant now and focus. Margin of safety pdf notes:

investing stockmarket financialsuccess coaching From pinterest.com

investing stockmarket financialsuccess coaching From pinterest.com

According to graham, “the margin of safety is always dependent on the price paid. Insist on a margin of safety the intelligent investor video the intelligent investor youtube the intelligent investor review the intelligent investor animate margin of safety book by seth klarman pdf summary review online reading download investing books investing strategy books Let us assume that the book value per share of a company is $10, but the market price of one share is $20. Margin of safety — don’t lose money; A margin of safety is necessary because valuation is an imprecise art, the future is unpredictable, and investors are human and make mistakes. A margin of safety is achieved when securities are purchased at prices sufficiently below underlying value to allow for human error, bad luck, or extreme volatility in a complex, unpredictable, and rapidly changing world.

A margin of safety is achieved when securities are purchased at prices sufficiently below underlying value to allow for human error, bad luck, or extreme volatility in a complex, unpredictable, and rapidly changing world.

The required margin of safety is the amount of discount (below the. Klarman, on why he wrote the book: We continue with the summary of the margin of safety by seth klarman which is by far one of the best books on value investing out there. The book is divided into three parts. Unfortunately, many more investors claim the The margin of safety tells the company how much they could lose in sales before the company begins to lose money, or, in other words, before the.

Source: pinterest.com

Source: pinterest.com

“there are only a few things investors can do to counteract risk: The margin of safety by seth klarman covers a broad spectrum from providing sound education on the psychology of investing as well as developing the quantitative and qualitative aspects of value investing. One of the most hyped books within the value investing community is probably margin of safety by seth klarman. The book value could be the intrinsic value if you believe the accountant’s estimate of assets and liabilities are the true value and there are not intangible values to be considered. They sit back and wait for the.

Source: pinterest.com

Source: pinterest.com

And these free pdf notes do a great isolating the actionable suggestions from margin of safety so that you can start to internalize and apply the value investing principals and methodology that margin of safety recommends. A great summary with everything you need to understand this book. The margin of safety by seth klarman covers a broad spectrum from providing sound education on the psychology of investing as well as developing the quantitative and qualitative aspects of value investing. It is sometimes said to be the most important book available on value investing after the intelligent investor by benjamin graham. Book summary — the little book of value investing.

Source: pinterest.com

Source: pinterest.com

Margin security summary this is my book summary of. It is adherence to the concept of a margin of safety that best distinguishes value investors from all others, who are not as concerned about loss. This informs management of the risk of loss to which a business is subjected by changes in sales. Value investors invest with a margin of safety that protects them from large losses in declining markets. A margin of safety is achieved when securities are purchased at prices sufficiently below underlying value to allow for human error, bad luck, or extreme volatility in a complex, unpredictable, and rapidly changing world.

Source: pinterest.com

Source: pinterest.com

The required margin of safety is the amount of discount (below the. The margin of safety is the reduction in sales that can occur before the breakeven point of a business is reached. Diversify adequately, hedge when appropriate, and invest with a margin of safety. These notes, prepared by robert redfield in 1991 offer a chronological summary of seth klarman’s margin of safety. Read the full book summary ».

Source: pinterest.com

Source: pinterest.com

A margin of safety is necessary because valuation is an imprecise art, the future is unpredictable, and investors are human and make mistakes. A margin of safety is necessary because valuation is an imprecise art, the future is unpredictable, and investors are human and make mistakes. They sit back and wait for the. Graham breaks the margin of safety down by comparing a stock issue with an earnings power of 9% / annum over bond interest rates at 4%. The book value of an entity is an accountant’s view of the value of the company.

Source: pinterest.com

Source: pinterest.com

It follows that value investors seek a margin of safety, allowing room for imprecision, bad luck, or analytical error in order to avoid sizeable losses over time. And these free pdf notes do a great isolating the actionable suggestions from margin of safety so that you can start to internalize and apply the value investing principals and methodology that margin of safety recommends. Those who can predict the future should participate fully, indeed on margin using borrowed money, when the market is about to rise and get out of the market before it declines. This is what rational investors do. Margin security summary this is my book summary of.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title margin of safety book summary by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.